XNF, XAU, XAG, XPT

XNF, XAU, XAG, XPT

What do these currencies have in common, other than an X?

They are some of the first currencies traded on the Ripple network that are backed by precious metals bullion reserves.

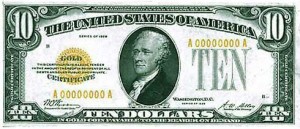

Ripple Singapore and XNFTrading are both full fledged Ripple gateways that are offering digital currencies backed by precious metals that you can hold in your wallet and spend instantly in any currency through the Ripple network. In many ways, the world has come full circle thanks to digital technologies. At one point in time, gold and silver were the only legal tender in the United States. As time went on, the government found it easier transact and transport IOUs of gold and silver instead of actual physical money. The United States Treasury issued these paper notes that were called Gold Certificates or Silver Certificates, and they were denominated in dollars. This is how paper currencies were born. Up until the early 20th century, paper currencies were still redeemable in gold and silver.

The Coinage Act of April 2, 1792 that was passed by the United States Congress and signed by President Washington, established the United States Mint and regulated the coinage of the United States. In this act, it specified the amount of gold and silver in each coin and their respective value in dollars.

The Coinage Act of April 2, 1792 that was passed by the United States Congress and signed by President Washington, established the United States Mint and regulated the coinage of the United States. In this act, it specified the amount of gold and silver in each coin and their respective value in dollars.

Essentially it boiled down to two simple facts: One dollar equaled 371.25 grains (1 troy ounce) of fine silver and ten dollars was 247 4/8 grain (16.0 g) pure gold. All other amounts were divisions or multiplications of these numbers.

Ripple Singapore and NoFiatCoin would make the Founding Fathers proud

The elemental symbol for gold is Au, for silver it is Ag, and you guessed it, the symbol for platinum is PT. Ripple Singapore has made it very easy to understand for everyone. One currency unit represents one ounce of each precious metal. Therefore, 1 XAU is one ounce of gold. You can redeem any of these precious metal IOUs for real gold, silver, and platinum bullion and have them mailed to your address throughout the world. Ripple Singapore adamantly backs each coin with 100% of its’ reserves. Like all precious metals dealers, they make their profits off the premium difference between the bid and ask price of precious metals on the marketplace. Ripple allows them to expand their business to a global market.

XNF is a little more abstract in its’ value, but nonetheless it can be redeemed for actual physical bullion. It is not directly pegged to a particular amount of gold and silver. Instead, it would be priced in US dollars and you can exchange your XNF for bullion as long as your order is $3000 or more. Therefore, XNF has a more speculative component to it. Time will tell if this is a good strategy or not. I for one am very curious how they move forward to gain trust and create liquidity using precious metals combined with digital currencies.

XNF is a little more abstract in its’ value, but nonetheless it can be redeemed for actual physical bullion. It is not directly pegged to a particular amount of gold and silver. Instead, it would be priced in US dollars and you can exchange your XNF for bullion as long as your order is $3000 or more. Therefore, XNF has a more speculative component to it. Time will tell if this is a good strategy or not. I for one am very curious how they move forward to gain trust and create liquidity using precious metals combined with digital currencies.

According to the XNF website:

At least 1/3rd of every batch of XNF released into the market is backed by Bullion, gold and silver coins. At times you will see that we are backed by 100 or 200%.

Crypt.la has conducted interviews with the founders of both Ripple Singapore and XNFTrading. I hope you take the time to check them out!

What do you think about combining cryptocurrency technology with precious metals? Do you live in a country with high inflation but have been unable to invest in precious metals due to the high prices? Please share your opinions below.

CoinJoint.info Bitcoin, Altcoin and Cryptocurrency news, coverage and more…

CoinJoint.info Bitcoin, Altcoin and Cryptocurrency news, coverage and more…