There are currently numerous websites that list and rank cryptocurrencies based on their market capitalisation (market cap). Examples include coinmarketcap.com, cryptmarketcap.com and bravenewcoin.com which can serve as very useful tools when analysing various aspects of cryptocurrency markets.

A potential problem when ranking cryptocurrencies purely by market cap is that some important statistics can be misinterpreted. The market cap of a coin is calculated by multiplying the total number of coins in supply with the latest price that the coins are trading for on exchanges. If a coin is premined then the calculated market cap can be inflated.

Imagine a hypothetical coin was released with a 50% premine and one million total coins. If you sold one coin for one dollar the market cap would instantly be 500,000 dollars.

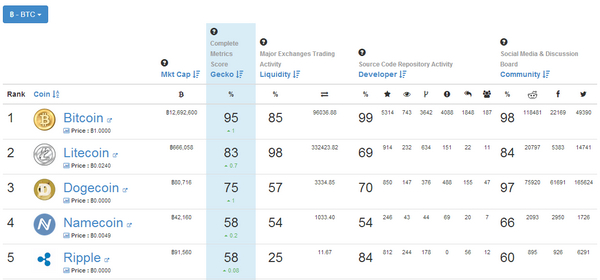

CoinGecko aims to collect all the data required to quantitatively and qualitatively rank the potential of an altcoin.

Short-term fluctuations in prices could also prove misleading when ranking by market cap.

CoinGecko aims to solve these problems using a more “holistic and quantitative” approach. The ranking algorithm takes into account other metrics focused around developer activity, community and liquidity.

| Criteria | CoinGecko | Importance |

|---|---|---|

| Developer | Uses development activity on public source code repositories (eg. Github) | CoinGecko tracks the development activity of the coins via public source code repositories. The reason why we are looking at this is that some coins are no longer maintained by the developer thus those coins would appear very unlikely to progress over time. By looking at how much interest and effort goes around the development community, there is a chance that the coin will continue to innovate according to how the cryptocurrency market sees fit. |

| Community | Looks at discussions and popularity of a coin from social media and forum content (eg. Bitcointalk, Reddit) | Cryptocurrencies tend to experience tremendous growth when there is a strong community backing it. A strong community contributes to new ideas and new features to be incorporated into the coin, increases trading volume, and signifies growth towards a bigger market. |

| Liquidity | Looks at the cryptocurrencies’ trading activity on all major exchanges. | Liquidity of altcoins can be used to measure its market share, market maturity, and market acceptance. The coin needs to be widely traded on exchanges to be considered a potential growing coin. |

Source: coingecko.com/methodology

The rankings which are generated using only these metrics (excluding market cap) can prove to be useful when assessing the potential of cryptocurrencies. If a coin has low liquidity, a lack of source code repository activity or low social media activity it might be an indication that it is not ‘healthy’ which might be not as obvious on other ranking sites that are based on market cap.

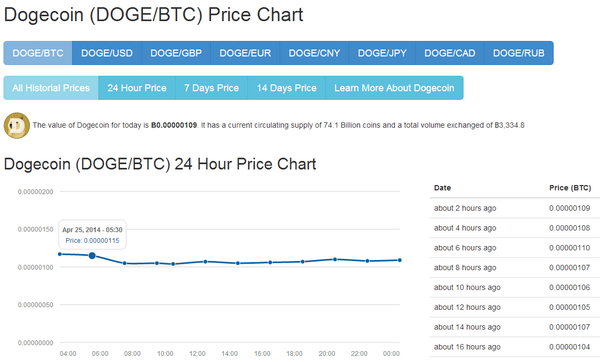

Each coin on the site has its own information page which gives and introduction and overview of the coin. There are also prices charts available in a number of fiat currencies.

CoinGecko is still currently in beta and more coins and developments are on their way. Overall I have found CoinGecko to be a very helpful tool and something that anyone involved with crypto currencies could easily utilise.

Visit CoinGecko at www.coingecko.com/

CoinJoint.info Bitcoin, Altcoin and Cryptocurrency news, coverage and more…

CoinJoint.info Bitcoin, Altcoin and Cryptocurrency news, coverage and more…