My original intent was to write a simple piece about mining cryptocurrency with leased rigs. Along the way, I uncovered some things that I felt were more important to communicate than how to find the best deal on a rig.

The same, seemingly endless, arms-race that the Bitcoin community has been living with is inevitable for altcoins too. It is driven by two factors, greed and ASICs. Greed comes first on the list because there are excess hash rates on many altcoins and at this time there aren’t any Scrypt ASICs to take the blame.

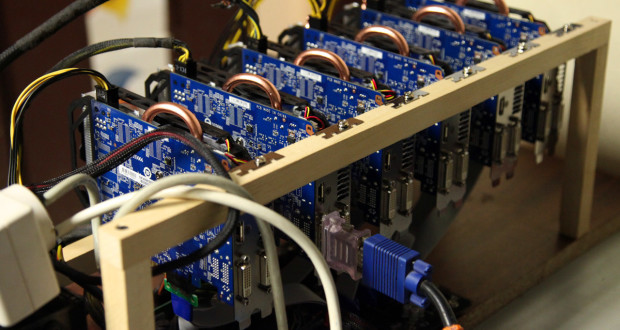

There is, however, a glut of mining hardware for lease at bargain basement pricing. This — along with a gross misunderstanding of how excess hash-rate and difficulty affect mining profitability — is creating conflict, stress, havoc and lost profits on some altcoin networks.

I have conceived of a few ways to quantify excess hash-rate, taking the blocktime into account. They involve examining the relevant blockchain to look for an unexpectedly large number of blocks that do not contain a single transaction that is unrelated to mining. For example, too many blocks that contains a single mining block reward may be an indicator that there is more hashrate than is needed to support tranactions on that network. The same is true for blocks that only contain pool, multi-pool and exchange related transactions that are all a direct result of mining.

Excess hashrate is an indicator of greedy mining and it hurts most miners on that network and benefits very few. The fact is, it really costs everyone, even the greedy miners themselves. Using some elementary mathematics, one can verify that they are earning less per hash as the hashrate climbs. Satoshi built in protection from greedy mining and it is quite effective.

It is interesting that some in the Bitcoin community believe that an excessive hash rate is a good thing as it lowers the chances for 51% attacks. I find this to be a somewhat weak, if valid, argument. Obviously there is much room for debate, discussion and improvement

So, how might we determine how much hashing is needed to support transfers on a network and how much is excessive? I would love to see some kind of service appear which offers up this kind data for a wide selection of coins. The ratio of ‘greedy blocks’ versus required blocks would be a valuable metric to begin with.

CoinJoint.info Bitcoin, Altcoin and Cryptocurrency news, coverage and more…

CoinJoint.info Bitcoin, Altcoin and Cryptocurrency news, coverage and more…

Pingback: Architectcoin (ARCH) integrates wallet, IRC and Bittrex monitoring. - CoinJoint.info